Ditch the Desk, Embrace the Data: How AI Streamlines Casualty Insurance Claims

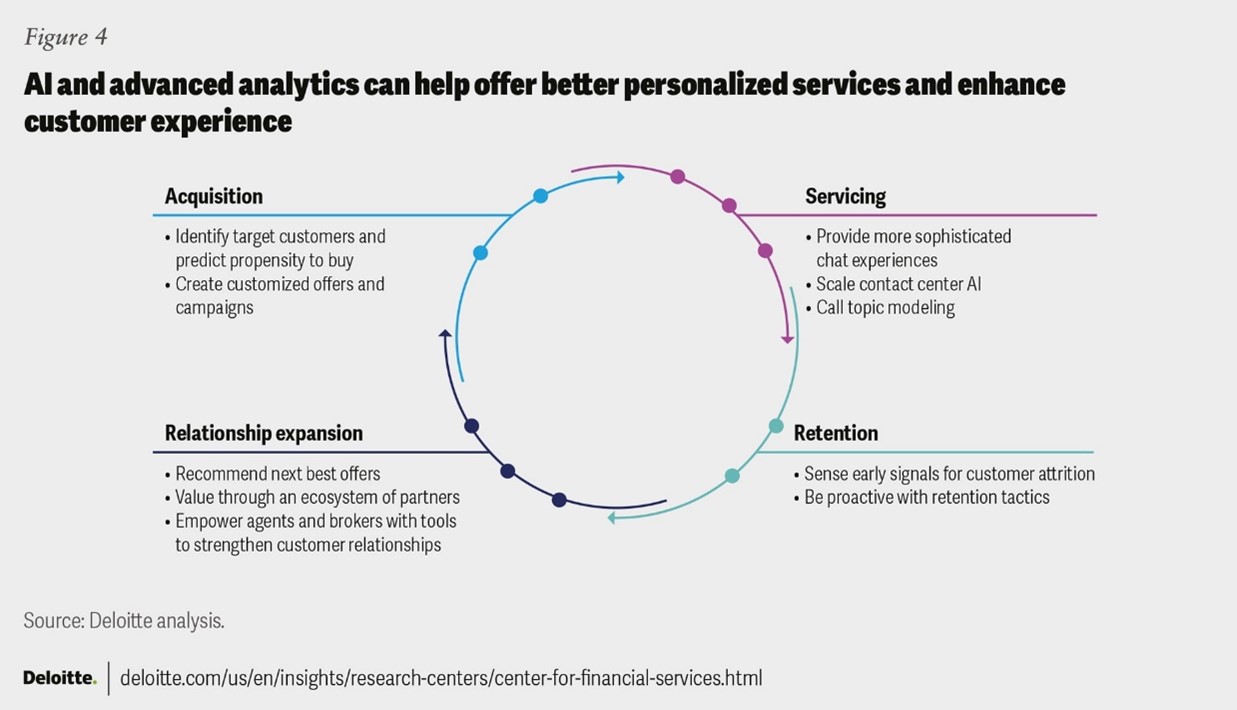

Advanced technology capabilities can help achieve operational targets such as improved underwriting for more accurate pricing and risk selection, bolstering claims management to limit loss costs, and improving efficiency by streamlining operations.

(Source) – Deloitte

Imagine a world where filing an insurance claim does not involve mountains of paperwork, endless phone calls, and weeks of waiting. It is a world where claims are processed swiftly, accurately, and even proactively, freeing up adjusters to focus on complex cases and providing policyholders with a seamless, stress-free experience. This futuristic vision is no longer a pipe dream – it is the reality offered by Artificial Intelligence (AI) in casualty insurance claims processing. This blog will delve into the magical world of AI-powered claims processing, showcasing its potential to revolutionize the industry.

Inefficiencies often plague the current state of claims processing. Manual data entry consumes time and resources, leading to lengthy turnaround times and frustrated customers. The cost of fraud adds another layer of burden, draining profits and eroding trust.

Fortunately, AI and automation can revolutionize this landscape. By harnessing the power of data and intelligent algorithms, insurers can unlock a new era of efficient, accurate, and customer-centric claims processing.

Source- Deloitte

AI to the Rescue: Transforming the Casualty Insurance Claims Arena

Under the Hood

The deployment of AI in the insurance industry is not a futuristic dream but a current reality. Specific AI applications are reshaping claims processing, enhancing efficiency, and improving overall customer satisfaction.

- Claims Triage and Assessment: AI algorithms can quickly assess the severity of a claim by analyzing historical data, images, and other relevant information. It is well-known in insurance that 20% of claims account for 80% of the total claim payouts. Randomly assigning claims wastes resources. This expedites the claims process and ensures critical cases receive immediate attention.

- Fraud Detection: Fraudulent claims pose a substantial challenge for insurers. AI systems equipped with machine learning algorithms can analyze vast datasets to identify patterns indicative of potential fraud. This initiative-taking approach helps insurers detect and prevent fraudulent activities, safeguarding the company and its policyholders.

According to a study and survey by Accenture (2022) that included

- Home and Auto Insurance Customers (6,784 Participants):

- Geographically diverse, spanning 25 countries.

- All participants have filed insurance claims within the last two years.

- Insurance Claims Executives (128 Participants):

- Representing 13 countries, providing a strategic view from industry leaders.

- US-Based Underwriters (434 Participants):

- Encompassing professionals at various career levels, from entry to executive/senior management.

- Inclusive of members of The Institutes, complemented by a sample list from the Risk & Insurance Group.

The AI Advantage: Making the Process Seamless

- AI presents a compelling solution to alleviate the burden on human resources in claims processing.

- Automated systems can swiftly analyze vast datasets, identify patterns, and process routine claims seamlessly.

- By harnessing machine learning algorithms, AI ensures quick and accurate decision-making, minimizing delays and errors.

The transition from a labor-intensive approach to an AI-driven model enhances efficiency and creates a more seamless and responsive claims processing system. By leveraging the power of AI, the insurance industry can optimize resources, improve customer satisfaction, and set a new standard for the future of claims management.

Accenture’s underwriting employee survey discovered that as much as 40% of underwriters’ working hours are dedicated to non-core and administrative tasks. This translates to a potential industry-wide efficiency loss of up to $160 billion over the next five years. Integrating AI and automation into the underwriting workflow is a significant opportunity to mitigate time spent on administrative activities, manual processes, and redundant data inputs.

AI: Transforming the Future of Insurance

At a critical juncture, the insurance industry must embrace Artificial Intelligence (AI) or risk obsolescence. Those integrating AI thrive in a customer-centric, efficient landscape marked by speed and accuracy. The competitive edge lies in quick adoption, unlocking vast possibilities for redefining insurance practices. Ethical implementation is critical, with rigorous human testing to prevent biases. Let’s transform the insurance claims arena into a realm of efficiency, fairness, and unparalleled customer experiences. AI isn’t just tech; it’s the beacon guiding the industry towards a brighter, inclusive future.

Join IMS Datawise at the forefront of insurance innovation! Ready to embrace the automation tide, we empower insurers with cutting-edge solutions for streamlined claims processing. Connect with us to revolutionize your operations, optimize resources, and offer unparalleled customer experiences in the ever-evolving casualty insurance landscape.

Reach us at info@imsdatawise.com