Every business has a deeper foundation. Whether managing distributed teams or handling thousands of customer touchpoints, businesses rely on seamless, behind-the-scenes operation systems.

Insurance has quietly become one of those systems.

Not just for reacting to risks, but for proactively supporting how businesses scale, serve, and stay sharp. Today’s Insurance business processes match how modern companies work. They are fast-paced, tech-driven, and focused on better results.

The shift toward digital insurance solutions has made accessing coverage easier, automating claims, and ensuring compliance – without disrupting core operations. Many businesses use business process management outsourcing (BPMO) for tasks like payroll, accounting, and customer support.Insurers and their partners now work in a faster, data-driven environment. This includes outsourced risk management and claims processing support.

This isn’t about risk anymore, it’s about rhythm. insurance process outsourcing is simply another part of the machine, tuned to keep everything running smarter and smoother.

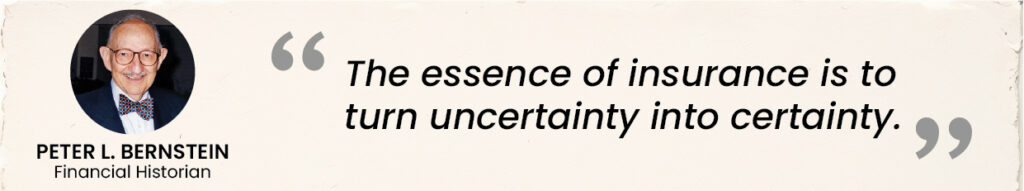

Evolution of Insurance

Insurance has always adapted to the needs of its time. What began as simple risk-sharing among ancient merchants has evolved into a global ecosystem powered by data, automation, and AI. The timeline below traces the most pivotal milestones in the insurance industry’s 4,000-year journey – showing how it continues to protect what matters the most.

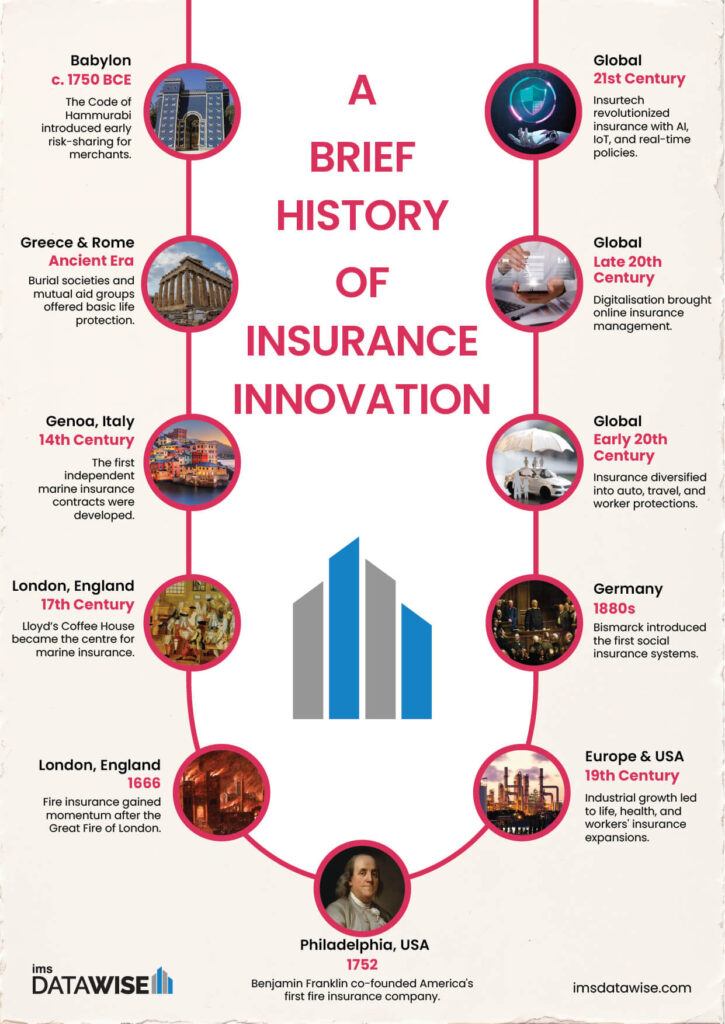

Types of Insurance

Insurance, in its broadest sense, serves both individual and enterprises. However, here’s how the nature of that service differs:

1. Personal Insurance:

- When we think of personal insurance, we think about ourselves and our families. This includes:

- Life insurance

- Health coverage

- Motor insurance

- Home protection

- Most of us depend on it without even realizing how much.

2. Business Insurance:

- On the other hand, business insurance solutions are built for organizations. No matter if you have a startup or a large-scale enterprise- you need protection.

- This protection is important for your people, operations, assets, and legal responsibilities. Commercial insurance plans, business risk insurance, and landscape insurance help companies deal with property damage. They also cover employee compensation and data breaches.

Key Challenges in the Changing Insurance Industry

Despite industry’s evolution, insurers face significant challenges. If you are a part of this world, you may have encountered one or more of these issues:

- Trying to keep up with ever-changing regulations. Regulatory environments are constantly shifting. Meeting insurance regulatory compliance requirements in multiple regions can be overwhelming and time-consuming.

- Handling more claims than ever before. With increasing climate volatility, cyber threats, and rising healthcare costs, claims volume is higher. So is the pressure to resolve them quickly.

- Fighting a war for talent. Onboarding and retaining skilled professionals is difficult, particularly those who can adapt to emerging technologies like AI, automation and analytics.

- Expected to deliver instant service. Today’s customers want faster service and digital-first engagement. That means you need to integrate smarter tools across the board.

- Managing risk on multiple fronts. From financial liabilities to natural disasters, cybercrime, and operational delays, risk management in insurance is becoming increasingly complex.

- Ensuring airtight compliance and audit readiness. Insurers must not only meet evolving regulations but also maintain detailed documentation, ensure data accuracy, and prepare for periodic audits, all without slowing down core operations.

Strategies for Overcoming Challenges

With the right blend of innovation and partnerships, you can overcome these hurdles.

- Automate processes and reduce manual errors. Tools like AI-assisted underwriting help you make accurate decisions faster while reducing human oversight.

- Outsource the non-core tasks. By working with experts in risk management, your internal teams can focus on what is important. This includes innovation and engaging with customers.

- Use data to your advantage. Predictive analytics and AI help you forecast claims, assess risk profiles, and prevent fraud before it even happens.

- Modernize customer experience. Think self-service portals, mobile apps, and virtual assistants. This isn’t just convenient; it is what today’s clients expect.

- Partner with specialists in insurance operations. Outsourcing isn’t just about cost savings anymore. Bringing in domain expertize and scalability when needed is essential.

IMS Datawise: Your Strategic Partner in Insurance Process Outsourcing

At IMS Datawise, we are your business process management outsourcing provider. We know that today’s insurance operations need more than just traditional back-office support. They require agility, precision, and a strong commitment to compliance and customer satisfaction.

Our solutions span the entire insurance process outsourcing. This includes claims administration, policy servicing, risk management, and underwriting support. We combine smart automation with human insight to achieve this.

Here’s what we bring when you partner with us:

- We streamline your claims process. We handle it with precision and empathy from the first notice of loss to the final settlement.

- We simplify policy administration. Whether onboarding a new client or updating coverage, we manage the full lifecycle efficiently.

- We handle compliance like pros. Our teams stay ahead of insurance regulatory compliance mandates, so you don’t have to worry about legal pitfalls.

- We help you take control of risk. We support you in our outsourced risk management services give you access to proactive risk mitigation strategies tailored to your business.

- We bring digital to the core. We focus on providing value with digital insurance solutions that grow with your needs. This applies to small business insurance as well as global portfolios.

By taking the operational burden off your shoulders, we let you focus on growth, innovation, and your customers.

Frequently Asked Questions (FAQs)

Q: What are digital insurance solutions?

A: These are tech tools like AI underwriting, automated claims processing, and digital customer engagement platforms. They simplify and speed up insurance operations.

Q: How can outsourcing help my insurance business?

A: It reduces your operational load, gives you access to specialized talent, and often improves accuracy, speed, and compliance.

Q: What is automated insurance underwriting?

A: It’s the use of algorithms and data to evaluate applications and determine pricing or eligibility—faster and more accurately than manual processes.

Q: What’s the difference between business and personal insurance?

A: Personal insurance covers individuals and their property, while business insurance focuses on operational and legal risks associated with running a company.

Q: Is IMS Datawise only for large insurers?

A: Not at all. Our services are scalable and designed to support everything from small business insurance operations to enterprise-level needs.