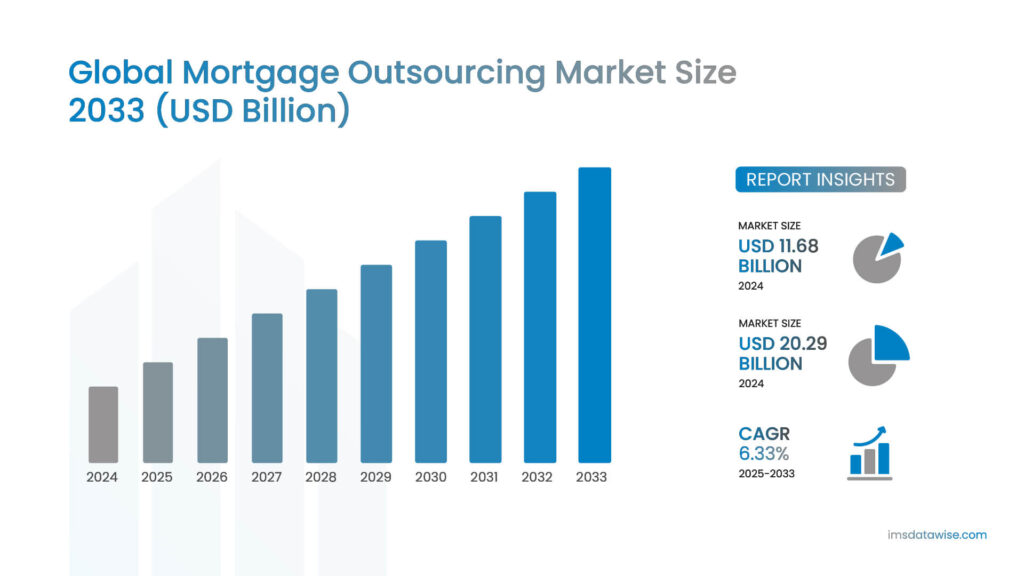

With a CAGR of 6.33% over the projected period, the global mortgage outsourcing market size was valued at USD 11.68 billion in 2024 and is expected to reach USD 12.419 billion in 2025, and USD 20.29 billion by 2033.

[Source: Business Research Insights]

As competition, compliance demands, and borrower expectations continue to rise, more lenders opt to outsource mortgage processing to streamline operations and focus on core competencies.

Selecting the right partner for business process management outsourcing in the mortgage industry is a tactical and strategic decision.

Key Factors to Consider When Selecting Mortgage BPMO Partner

1. Industry Experience and Specialisation

A capable outsourcing partner must possess demonstrated experience with mortgage processing services. They should demonstrate a deep understanding of documentation, market trends, and regulatory cycles.

Key Evaluation Point: Ask how they handled high-volume periods or major regulatory shifts for other lenders.

2. Regulatory Compliance and Data Security

Security and compliance are foundational to business process outsourcing services in the mortgage space. The partner must meet standards such as GDPR, HIPAA, Cyber Essentials, etc.

Key Evaluation Point: Validate their security frameworks, compliance certifications, and business continuity plans.

3. Technology Integration Capabilities

Strong technology capabilities support automated verifications, real-time tracking, and LOS/CRM integrations. These are essential for error reduction and enhanced borrower experiences.

Key Evaluation Point: Confirm whether the partner supports API-based integrations, workflow tools, and dashboards.

4. Process Transparency and SLA Adherence

To maximize the benefits of outsourcing mortgage loan processing, there must be process visibility, accountability, and agreed-upon performance metrics.

Key Evaluation Point: Insist on daily SLA reports, escalation workflows, and consistent performance audits.

5. Talent Quality and Training

Outsourcing mortgage processes demands skilled professionals trained in underwriting, loss mitigation, and documentation accuracy. Continuous learning is critical.

Key Evaluation Point: Review the training programs, domain certifications, and employee evaluation cycles.

6. Customisation and Flexibility

Lender requirements can vary significantly. Your BPMO partner must offer adaptable workflows and engagement models.

Key Evaluation Point: Choose partners who support hybrid models and on-demand scalability.

7. Cost Effectiveness with Value

Value is more than savings. It is about reduced rework, regulatory alignment, and improved customer trust.

Key Evaluation Point: Evaluate long-term ROI, not just the lowest quote.

8. Credibility Through Results

Proven performance is the ultimate indicator of a partner’s capability. Reputable business process management outsourcing solutions providers offer strong references and proven case studies.

Key Evaluation Point: Speak with current clients to understand response time, adaptability, and results.

Navigating these critical decision points is the key to unlocking the full potential of mortgage process outsourcing. The objective is to secure a partner equipped to enhance compliance, scalability, and ROI, allowing your team to focus on its core mission of serving borrowers.

IMS Datawise: Your Mortgage Business Process Management Outsourcing Partner

Operational precision, compliance leadership, and scalability are essential factors to consider when selecting a mortgage business process management outsourcing partner. IMS Datawise provide all three.

As a trusted partner to leading mortgage lenders, IMS Datawise provide end-to-end business process management outsourcing (BPMO) solutions that combine deep domain expertise, advanced technology, and unwavering compliance.

IMS Datawise BPMO solutions cover several important mortgage lifecycle operations:

Core Processes

- Loan Origination

- Default Management / Loss Mitigation

Sub-Processes

- Document Ordering and Verification

- Property Inspection Coordination

- Repair and Preservation Validation

Lenders outsource mortgage processing to cut costs, improve speed, ensure compliance, and easily handle fluctuating loan volumes.

Discover How IMS Datawise’s End-to-End BPMO Solutions Can Transform Your Mortgage Operations.

Frequently Asked Questions (FAQs)

- What do mortgage outsourcing service providers do?

They handle end-to-end or specific mortgage processes such as origination, verification, and loss mitigation for lenders. - Why should lenders consider Mortgage BPO services?

To reduce operational costs, improve turnaround time, and ensure compliance during fluctuating loan volumes. - Is Mortgage BPMO secure and compliant with regulations?

Yes, trusted providers follow standards like FCRA, TILA, and GDPR, as well as data encryption and audit mechanisms. - How do I choose the right Mortgage BPMO partner?

Evaluate based on experience, compliance, technology, talent, flexibility, and client feedback. - Is Mortgage BPMO suitable for small and mid-sized lenders?

Yes, it offers scalable and cost-effective solutions tailored to their operational needs.